This letter was submitted to LebTown. Read LebTown’s submission policy here.

Is something a lie if it’s carefully worded to be true – but is intentionally misleading?

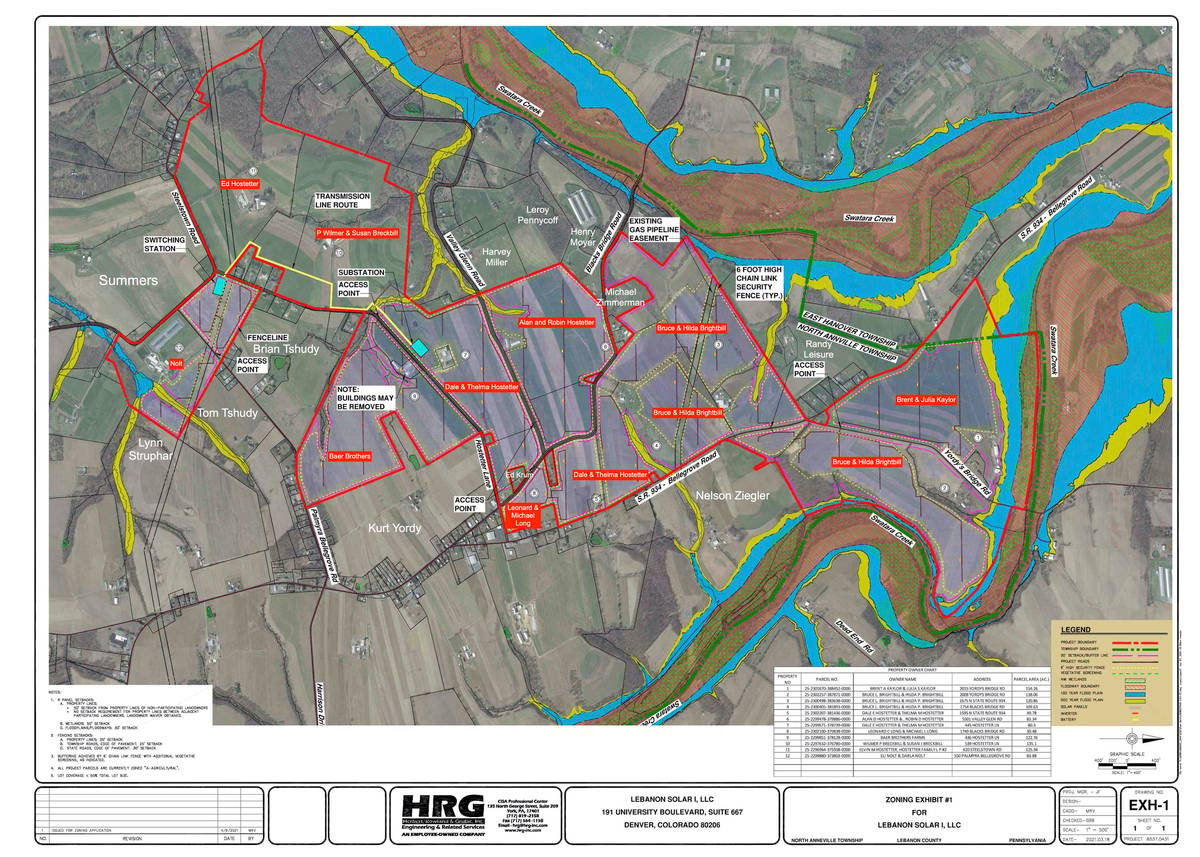

Enel SpA is the European conglomerate behind the Lebanon Solar project located in North Annville Township. Lebanon Solar would be the largest industrial solar site in Pennsylvania, and one of the five largest in the eastern USA. Enel has started their charm offensive, with a Facebook page, school board presentations, and community conference calls. They claim they’ll be helping our local communities by contributing significant new tax revenue.

Enel is a multinational company that earned nearly $76 billion in revenue last year and made $5.2 billion in profits (see footnote #1 below). Their market capitalization is $80 billion. They know exactly what they’re doing, and they are intentionally misleading the community about their future tax contributions. I’ll break it down below.

Their claims

On August 12, Enel hosted an open Q&A with the community about their project. Enel project manager Eric Holton outlined the back taxes that Enel will pay to the community. They’ll have to pay $1M for breaking out of Clean & Green. Of that, $150K will go to Lebanon County, $150K will be earmarked for farm preservation (gotta love that irony!), and $700K will go to Annville-Cleona School District. Mr. Holton went on to say:

“So we will owe over one million dollars in the first year of this project alone…and that’s just the first year alone. The second part are the annual taxes due every year. Now, I was hoping to come here with an estimate tonight. Turns out to be a very complicated calculation. We are working with with the county try to come up with that and we do expect to have it in the next few weeks. But I can tell you that with with the $1 million upfront and the annual taxes do over the course of the 30 plus years, we’re talking about millions of new tax revenue coming into the local into the local economy.”

Note the careful wording that makes it sound like there will be significant tax contributions every year (“that’s just the first year alone…we’re talking about millions of new tax revenue….”). Also note that Mr. Holton punted on providing any actual numbers (“…a very complicated calculation”). Trust me, I’ve worked at big companies, and an $80 billion company doesn’t have any trouble calculating the taxes they’re going to owe on a project. There’s a reason Enel doesn’t want us to know the specifics.

The reality

Lebanon County property owners pay three types of taxes: County, School District, and Municipal. I link to the details below in footnote #2. I am focusing on the incremental tax that Enel will pay after removing these farms from Clean & Green—in other words, the taxes over and above what the hard-working farmers all pay today (at “Use Value”). So what additional tax revenues is Enel bringing to the community?

- Enel’s School and County Taxes

Yes, Enel will pay $700K to AC Schools in the first year and another $300K to the county / farm preservation. This isn’t a gift–they are legally required to pay it because they are taking these farms out of Clean & Green, which is a step backward for conservation and character of the community. Going forward, they will have to pay taxes at the “Fair Market Value” of the land–whereas the farmers in Clean & Green previously paid taxes based on the “Use Value” of the land (for details on this, see footnote #3 below). This one-time payment will be nice for the schools, but it comes at a cost: development. C&G provides a tax break to farmers who commit to not developing their land. Enel would have to pay back taxes because they want to break that agreement.

We don’t know the precise amount they’ll pay each year, but we can estimate it.

When someone removes property from C&G, they must pay the back taxes that they would have paid (on Fair Market Value) vs what they actually paid (at Use Value) for the current year plus six prior years, with a 6% interest penalty per year (footnote #3). In their August 12 propaganda call (and in a recent school board presentation), Enel tells us they’d have to pay $1M of back taxes, and they give us the breakdown–70% ($700K) to the school district and 30% ($300K) to the county–that’s for 7 years’ worth of incremental tax payments. We can work backward with that 6% interest figure to determine that the incremental tax they’ll be paying each year is about $94,350 per year after exiting C&G (contact me on Facebook if you want the math). 70% of that to the school district means $66,045 per year to the Annville-Cleona schools each year going forward, after paying those back taxes and penalties.

Is that going to make a difference for our schools? For 2021-22, the AC School Budget is $28,119,419 (footnote #4). So the incremental $66,045 that Enel will pay equates to just 0.24% of the annual AC school budget. It’s almost a rounding error.

Wait, WHAT?! I thought Enel was this huge benefactor who is about to bestow “millions of new tax revenue” on our community?!

Hmm. Well, if these benefits are not in the school taxes or the county taxes, they must be in the municipal taxes to North Annville, right?

2. Enel’s Municipal Taxes

Umm, this is awkward.

North Annville is one of two municipalities in Lebanon County that has NO MUNICIPAL TAXES None. Zip. Zilch. And Enel knows it, and they love it. I asked Enel about this on the call last week.

From the actual transcript:

Hey Eric. It’s Grady Summers. I’m curious, on the question of taxes. You said it’s complex. I know you’re aware that we’re one of only two municipalities in the county that does not have a local millage tax on properties. So when you talk about future property taxes that Enel will pay, what form would that be? Because you’re not going to be paying any additional taxes on the land. Because none of us do.

I mean, is it possible you might not be paying any incremental local taxes because of our favorable tax treatment in the Township?

Eric from Enel responded to my question:

Well, we are paying land taxes, just that it’s not being directed into the North Annville coffers, so to speak, it’s going through the school district. It’s going through the county. Now your question is definitely a fair one, and I think you bring it up because you’re right, North Annville is one of those two municipalities that does not have a local municipal tax. Now that’s today. And it’s been that way for quite a while, I understand it’s not necessarily the case tomorrow. So North Annville, my understanding has other fortuitous revenue sources, and it doesn’t seem to have a ton of local expenses. If either of those changes–that revenue source dries up, or there’s new local municipal costs that aren’t anticipated, having a commercial project like this one, we’ll be able to bear the brunt of any new tax that that comes up, that comes forth.

Did I read that correctly?! Enel is going to destroy the beauty of our community and decimate our property values for a 0.24% contribution to the local schools and their future ability to pay a hypothetical tax? Even if North Annville were to add a municipal property tax someday, all of us residents would be paying the same rate that Enel pays–the same rate that anyone who owned that property would pay. Unfortunately, there’s no special tax rate that applies only to nefarious multinational conglomerates.

In summary

- Enel made over $5 billion dollars in profit last year.

- They’ll make a one-time payment of$700K to the Annville-Cleona school district (just 2.5% of our annual school budget), a mandatory penalty because they’re developing the land and removing it from Clean & Green.

- They’ll pay an ongoing incremental annual school tax equal to a mere 0.24% of the AC school budget (plus $28K+ to the county).

- Enel will pay zero North Annville municipal taxes (we don’t have any). They’ll tear up our roads with construction equipment, kill our views, plant steel and glass into local farmland, decimate our property values… and the local residents will see no benefit.

If you support this solar project, that’s fine—I’ll respect your opinion. But you can’t support it because you think it’s financially good for our community–the facts just don’t support it. Enel spends millions of dollars in marketing every year, and they’re good at what they do. They’ll spin the facts, they’ll twist words, and they’ll play with numbers. But ask them to go on the record and tell you how much incremental tax revenue they’ll bring into the community—and see if you get the truth.

Footnotes

(1) Enel’s 2020 financials are here (remember, results are in Euros—convert to USD to get my numbers above): https://www.enel.com/content/dam/enel-com/documenti/investitori/informazioni-finanziarie/2020/trimestrali/fy-2020-risultati.pdf

(2) Lebanon County municipal taxes are here: http://www.lebcounty.org/depts/Commissioners/Documents/Tax%20Rates%20Jan-Jun%202021.pdf

(3) Clean & Green details are here: http://www.lebcounty.org/depts/Assessment/Documents/Clean_and_Green-Lebanon_Booklet_for_web.pdf. Note the relevant sentences: “Simple interest at 6%, annually, will be imposed on the roll-back taxes due as a result of a change in use to an ineligible use. If the property has been enrolled in Clean and Green for more than seven (7) years, the Act limits the amount of roll-back tax that is assessed to the current year and the six (6) previous years in which the land was enrolled in Clean and Green.”

(4) AC School budget for 2021-22 is here: https://www.acschools.org/site/handlers/filedownload.ashx?moduleinstanceid=155&dataid=20541&FileName=2021-2022%20Final%20Budget.pdf

Grady Summers lives in North Annville Township.

Want to submit your own column?

Learn more here.