A program that benefits fully and permanently disabled wartime veterans has changed its guidelines twice in recent months.

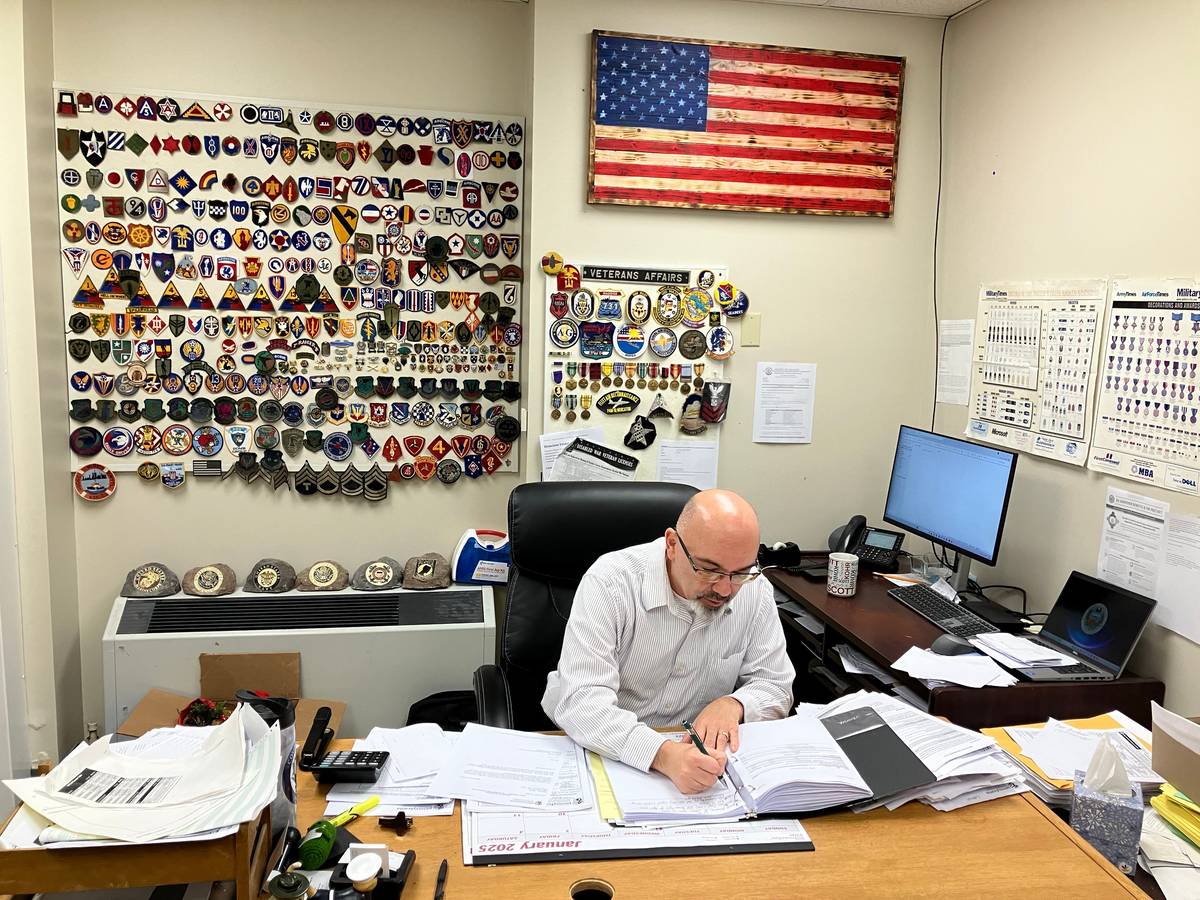

Scott Kohr, director of Veterans Affairs for Lebanon County, said there have been two major revisions since last summer to the statewide real estate tax exemption program for those veterans.

“As of August, the state no longer considers VA (Veterans Administration) disability benefits as income,” said Kohr. “As of Jan. 1, the state raised the rate of income (for program eligibility) from $108,000 to $114,637.”

There are various eligibility requirements to qualify for the program, according to Kohr. (A full list of guidelines and requirements can be found on the website of the PA Department of Military Affairs.

“No. 1, the veteran getting compensated must be at 100 percent total and permanent (disabled),” said Kohr. “And what I mean by total and permanent is that there are some instances where a veteran can be temporarily 100 percent.”

Kohr said an example is when a veteran has a curable illness, so those individuals are given a temporary disabled status. “The reason the VA does that is basically they’re stating that the disability could be treated and that person could be better in the future. So that’s why they give them temporary 100 percent disability.”

The second requirement is that veterans must have served active duty during what’s defined as a period of time when the United States is at war.

“World War II, Korea, Vietnam, and then today, the global war on terrorism, which started on Aug. 2, 1990, and that’s been ongoing until the present,” said Kohr. “They must have served, like I said, at least one day active duty during that time period to be eligible. Unfortunately, we do have a lot of peacetime vets that are 100 percent disabled that … are not eligible for this program.”

Kohr added that a veteran doesn’t have to be deployed to an actual war zone to qualify.

“I have a lot of veterans that never went to Vietnam, but they served during that time period. For whatever reason, the federal government sent them somewhere else. So they never actually served boots on the ground in Vietnam,” said Kohr. “However, they were still classified as wartime veterans because there’s always that chance that they could have said, ‘You know what? You’re going to Vietnam or I need you in Afghanistan or wherever.’ There’s that chance that they could have been called up and sent to serve in a war zone, so that’s why they are classified as a wartime veteran.”

Kohr noted that individuals who served in the Reserves or National Guard, however, must have been deployed to qualify because their service is otherwise classified by the state as training-based.

A third requirement is the aforementioned income threshold that was adjusted upward at the beginning of this calendar year.

There are two other primary factors for a veteran to qualify for a real estate tax exemption through Pennsylvania’s program.

“The law requires that the deed must be titled in either the veteran’s name or veteran and spouse’s name,” said Kohr. “If there’s anybody else on the deed, for instance, a child, a girlfriend, a boyfriend, they would be ineligible for the state exemption. The state only asks that the veteran and/or spouse be on the deed. Even if it (the deed) is in a trust, the state will not accept it.”

Kohr also said veterans can only get an exemption on one property that is their home. “The deed must be titled in the veteran’s name and they have to be residing there,” he added.

The removal of VA benefits last summer as a contributing factor to a veteran’s overall income for the minimum threshold has led to a spike in business at Lebanon County’s Veterans Affairs office, according to Kohr.

“Here in Lebanon County, I had forewarned them (commissioners) back in July when the state was going to make this change a month later,” he said. “I think there were like 40 some within the past year that had applied here in Lebanon County that were not eligible because their income was too high.”

State notification to those veterans helped make an impact in the county’s exemption numbers, which grew from 427 at the end of 2023 to 570 a year later. Kohr added he has even more fully disabled veterans waiting approval by commissioners at a public meeting.

“The state had reached out to all the veterans who had applied within the last year and alerted them that this was going to be taking place and to go ahead and reapply. So yes, once Aug. 16 came around, there was a definite influx in the veterans coming in here,” Kohr said. “It doesn’t seem like a lot when you look at the numbers and stuff like that, but it is significant. I mean, right now I probably have like seven or eight veterans that I have scheduled coming up within the next month to go on the property tax exemption (list).”

Kohr said he believes this program is a god-send for the men and women who have served their nation.

“This is a program that is absolutely wonderful for state veterans because they are also exempt from the municipality tax and the school tax in July, too,” he said. “It is a very important program if they are 100 percent, they went through some stuff. While no amount of money is going to change what they went through, whether that was a physical disability or a mental disability, it is still a small token of appreciation for their service. Nine times out of 10 they tell me they want their health back. No amount of money can change the way you feel.”

Kohr said he believes the real estate tax exemption program will continue to grow in 2025 and beyond.

“That number is only going to continue to grow,” he said. “I mean, we’ve got the VA (hospital) in our backyard and we’re getting a lot of veterans that are moving into this area because of the VA.”

Kohr said the local VA facility is motivating veterans to move to the Lebanon Valley.

“That is a big selling point that they have accessibility to the VA and I’ll ask them, you know, ‘Why did you move from Florida up here?’ They say it’s because of the VA. We heard good things about it and we like the accessibility to it. So that’s a big selling point. We’re only going to get more and more applicants as time goes on.”

Veterans who have questions about this program can contact Kohr’s office by calling 717-228-4422 or by visiting the county’s VA office’s website page.

Questions about this story? Suggestions for a future LebTown article? Reach our newsroom using this contact form and we’ll do our best to get back to you.

Keep local news strong.

Cancel anytime.

Monthly Subscription

🌟 Annual Subscription

- Still no paywall!

- Fewer ads

- Exclusive events and emails

- All monthly benefits

- Most popular option

- Make a bigger impact

Already a member? Log in here to hide these messages

Quality local news takes time and resources. While LebTown is free to read, we rely on reader support to sustain our in-depth coverage of Lebanon County. Become a monthly or annual member to help us expand our reporting, or support our work with a one-time contribution. Cancel anytime.