This article is shared with LebTown by content partner Spotlight PA.

By Charlotte Keith of Spotlight PA

HARRISBURG — Pennsylvania’s finances received a welcome — but probably temporary — boost in July, with tax collections up 6.6% compared to the same time last year, according to figures released Monday by the state’s Independent Fiscal Office.

Pent-up demand from shoppers after months of business closures buoyed sales taxes, the fiscal office said, while federal relief programs — including enhanced unemployment benefits that have since expired — helped cushion the blow of furloughs and layoffs.

Income tax withheld from employees’ paychecks was down 4.3% compared to last year, reflecting the high unemployment rate.

The coronavirus outbreak has already upended the tax revenues the state relies on to balance its budget and fund crucial services.

Between April and June, Pennsylvania’s tax revenues were down by more than 30% compared with last year, according to an analysis by the Urban Institute, a Washington, D.C. think tank.

Click here to donate to Spotlight PA

“Pennsylvania is not alone,” said Lucy Dadayan, senior research associate at the Urban Institute. “Almost every other state is in a terrible situation, too.”

Without more federal aid, states will have no choice but to consider dramatic budget cuts, higher taxes, and new sources of revenue, Dadayan said.

The state Department of Revenue has not yet developed monthly revenue estimates for the new fiscal year, which began July 1, a sign of the ongoing uncertainty around the pandemic’s impact.

“We’re working as quickly as we can to process returns so that we’ll have a clearer picture of anticipated revenue collections for the remainder of the fiscal year,” Revenue Secretary C. Daniel Hassell said in a statement.

Gov. Tom Wolf and state lawmakers will rely on those estimates when they return to Harrisburg to agree on a budget for the remaining seven months of the fiscal year.

In May, citing the challenge of predicting the impact of the virus on the state’s finances, lawmakers passed an unusual, temporary budget that holds funding for most areas steady for five months. Education was funded for a full year.

Adding to the uncertainty, congressional leaders have yet to reach an agreement on a second federal relief package. A key point of contention: whether to provide more aid to states and cities facing looming budget deficits after the pandemic slowed economic activity for much of the spring.

Under current federal rules, Pennsylvania cannot use any of the almost $4 billion it received under the CARES Act to offset revenue shortfalls. U.S. Senate Republicans have proposed loosening that restriction, which would give the state more flexibility in how to spend the roughly $1 billion lawmakers held in reserve.

Their proposal does not, however, contain any additional aid for states. House Democrats, by contrast, want to give state and local governments another $1 trillion in aid.

State officials say more money is sorely needed.

The coronavirus outbreak will cost Pennsylvania almost $5 billion in lost tax revenue through next June, the Independent Fiscal Office estimates — although this assumes a relatively quick economic recovery, without the need for a second round of statewide business closures.

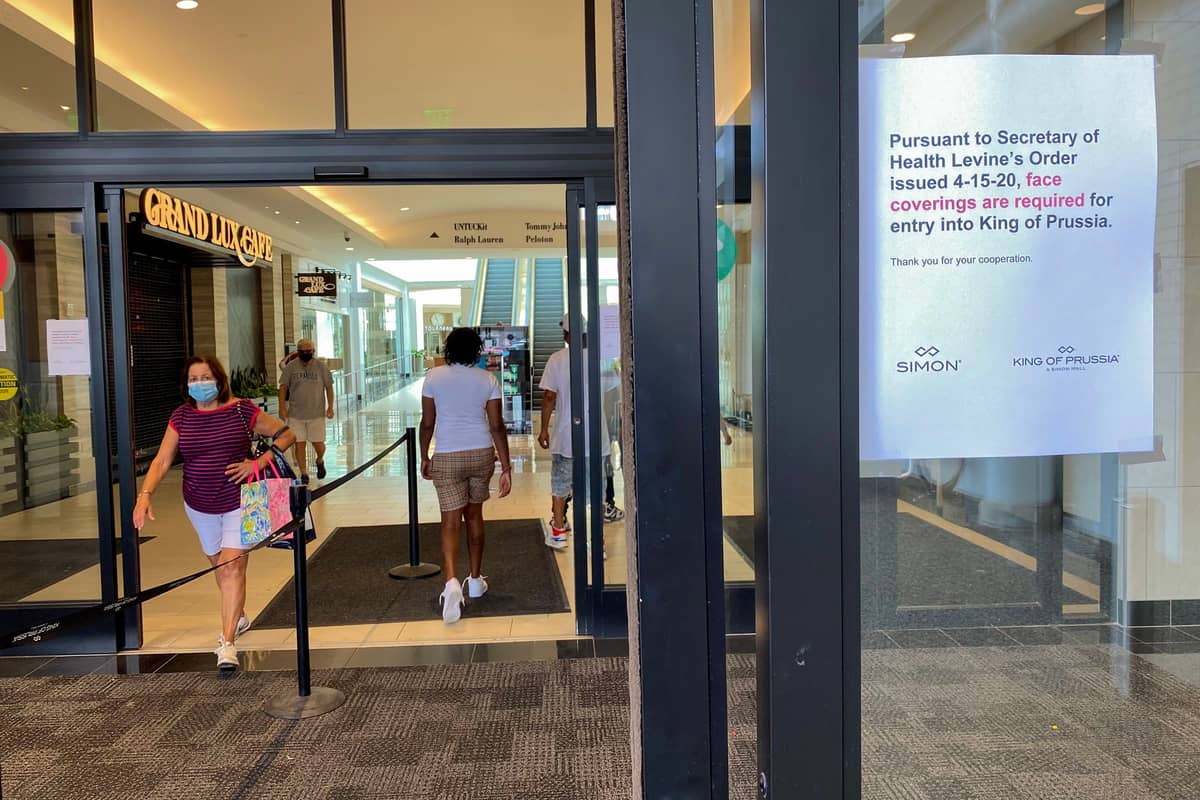

All of Pennsylvania’s counties are currently in the least restrictive “green” stage of the governor’s phased reopening plan. But as cases continue to rise in some parts of the state, Wolf has tightened restrictions on bars and restaurants and added new limits on indoor gatherings.

100% ESSENTIAL: Spotlight PA relies on funding from foundations and readers like you who are committed to accountability journalism that gets results. If you value this reporting, please give a gift today at spotlightpa.org/donate.

Read all of LebTown’s COVID-19 coverage here.

Is there a story you think LebTown should report? Let our newsroom know using the form below.

Help us provide journalism Lebanon County needs.

If you are thankful for LebTown, consider joining as a member. Members get an inside look at our publishing schedule each week, plus invites to a members-only Facebook group and happy hours.

Learn more and join now here.

Subscribe to our newsletter for updates each weekday at 3 p.m.