Beginning July 1, the Lebanon County Treasurer’s Office will handle tax payments on behalf of Lebanon city residents.

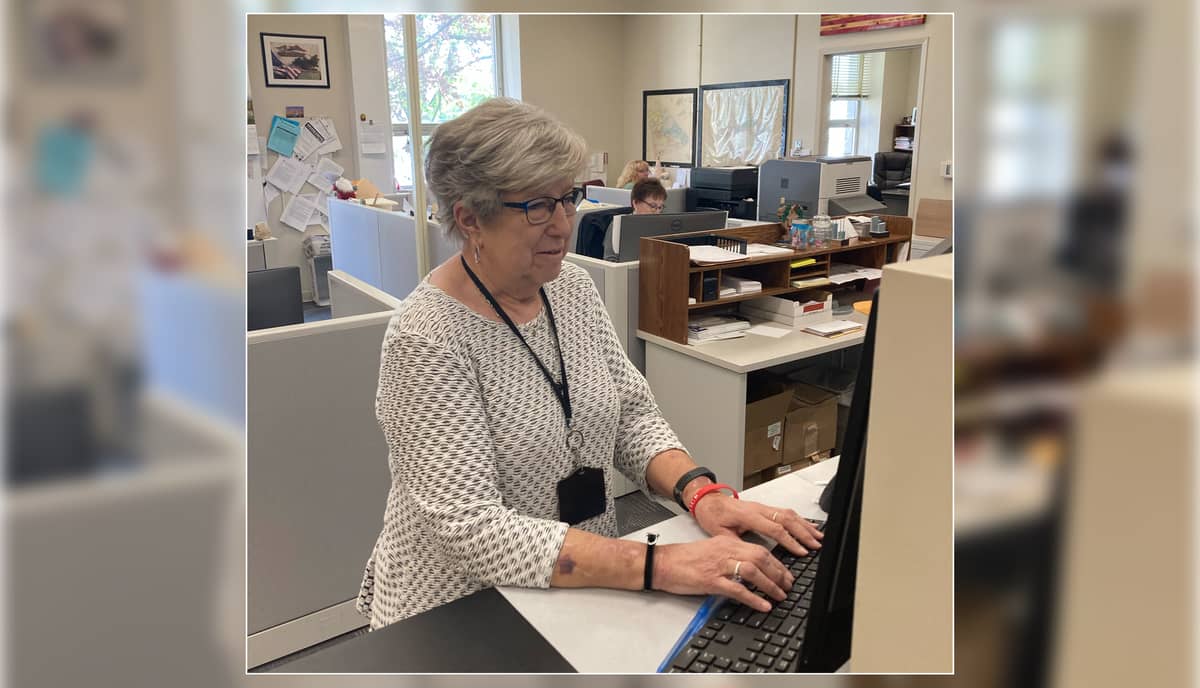

The move from using an out-of-county collector to one based in the city was done with one goal in mind, according to Lebanon County treasurer Sallie Neuin.

“This makes it a lot easier for city residents to pay them,” said Neuin. “The old one (collector) didn’t have an office here and we were getting people coming in to try and pay them at our office.”

Problematic for city residents was the lack of access to a tax collector locally since the former one is based in Allentown. Although that company has numerous offices across the state, none are located in Lebanon County.

“If a taxpayer had an issue, they had to call their main office in the Lehigh Valley,” added Neuin.

Although the county was unable to collect residents’ taxes, that didn’t stop them from trying to pay them at the treasurer’s office.

“When people came in here to pay their taxes, we couldn’t handle it nor could we give a receipt to those who wanted one because we weren’t accepting tax payments,” Neuin said. “Since we were getting these walk-ins, I talked with former Lebanon district business manager Curt Richards and we both agreed it was better to start offering that service in Lebanon County.”

Kelly Herr, business manager for Lebanon School District, agreed with Neuin why the change in collectors was made.

“We wanted our residents to be able to pay their real estate taxes in person,” said Herr. “EIT (earned income tax) and LST (local services tax) are still with Keystone, but we broke away from Keystone and went with Berkheimer for real estate. When we did that, we did get some comments from people saying that they did wish we had an office in Lebanon where they could come and hand over their check.”

Herr said the school district and county treasurer’s office made the decision to collect real estate taxes first in West Lebanon Township about two years ago. West Lebanon Township is the other municipality located within Lebanon School District.

“We started small because Sallie and her team were willing to do it, but they were also in the midst of a software conversion at that time, so we didn’t want to just throw everything at them,” said Herr.

Herr said the success of the working relationship with the collection of West Lebanon taxes included getting accurate tax reports on a timely basis, which are then used during auditing.

“Once we were all comfortable and they felt they were at the point with their software that they could take on the additional collection of Lebanon city, then that’s when we started discussions with Sallie and we took it from there,” added Herr.

Neuin emphasized that city residents will notice few changes – other than the bill will look a little different. The bill will still be mailed around the first of July and, while an online portal doesn’t exist yet, the office is moving to add digital payments online within the next two months. Herr added that all of the pertinent tax information will be on the new tax document.

“They can come in and pay it at the office and although there is no online portal now, hopefully we’ll have it ready when it starts. People can mail it to our office, too,” said Neuin.

The county will also utilize an onsite payment dropbox, located near the intersection of Elm and South Eighth streets in the city for the convenience of taxpayers, adding it will be open for drop-offs during regular business hours but closed over the weekend.

“There will be a dropbox out for people to put their tax payments in,” said Neuin. “It is the old city drop box and it is at the overflow parking lot on South Eighth Street.”

Neuin said offering local collection services makes sense since the county was already collecting school real estate taxes for West Lebanon Township.

“There are about 340 parcels in that municipality,” said Neuin, “and now we’ll be adding about another 8,400 to it.”

Adding this service won’t strain office resources or necessitate overtime. The office is already well-versed in handling tax collections since it collects municipal taxes for all but three: Bethel and Millcreek townships and Mount Gretna Borough.

“There are about 55,000 tax bills that are sent by the county,” added Neuin.

Asked if the county may look to handle more school district taxes in the future drew a bit of a laugh from Neuin.

“Not even thinking about that at this point,” she said. “Let’s wait and see how this one goes first.”

City residents who have any questions about the new collection process can call the county treasurer’s office at 717-228-4200 during business hours, 8:30 a.m. to 4:30 p.m. Monday through Friday. Those are the same hours that the dropbox will be open for residents who want to put their payments there.

Questions about this story? Suggestions for a future LebTown article? Reach our newsroom using this contact form and we’ll do our best to get back to you.

Keep local news strong.

Cancel anytime.

Monthly Subscription

🌟 Annual Subscription

- Still no paywall!

- Fewer ads

- Exclusive events and emails

- All monthly benefits

- Most popular option

- Make a bigger impact

Already a member? Log in here to hide these messages

Local news is disappearing across America, but not in Lebanon County. Help keep it that way by supporting LebTown’s independent reporting. Your monthly or annual membership directly funds the coverage you value, or make a one-time contribution to power our newsroom. Cancel anytime.