Lebanon County and Boscov’s have reached an out-of-court settlement that lowers the assessed value of four properties owned by the retail chain by $1 million.

Last fall, Boscov’s had appealed in county court a decision by the Lebanon County Board of Assessment that had denied the Reading-based company’s request to lower the assessed value of four properties it owns at the Lebanon Valley Mall.

Read More: Boscov’s appeals county assessment decision on four mall properties

Boscov’s sought to lower the assessed value of its main store, its furniture outlet, and two buildings it owns and leases, the Jack Williams Tire Center and Popeyes restaurant, which are both located along Route 422. All four properties are located in West Lebanon Township and Lebanon School District, with the remainder in the Lebanon Valley Mall, which is also owned by Boscov’s, situated in North Lebanon Township.

At the October hearing before the county assessment board, York-based appraiser Ryan Hlubb and Richard Nuffort, Boscov’s legal counsel, said their calculations of those properties’ current market valuation should be $6.14 million instead of $7.67 million.

The county’s Board of Assessment, which is administered by the three county commissioners, voted unanimously on Oct. 6 to make “no change” to the store’s current market valuation, which meant its assessed value would remain at $5.5 million. The vote prompted Boscov’s officials to appeal that decision in the county’s Court of Common Pleas on Oct. 31.

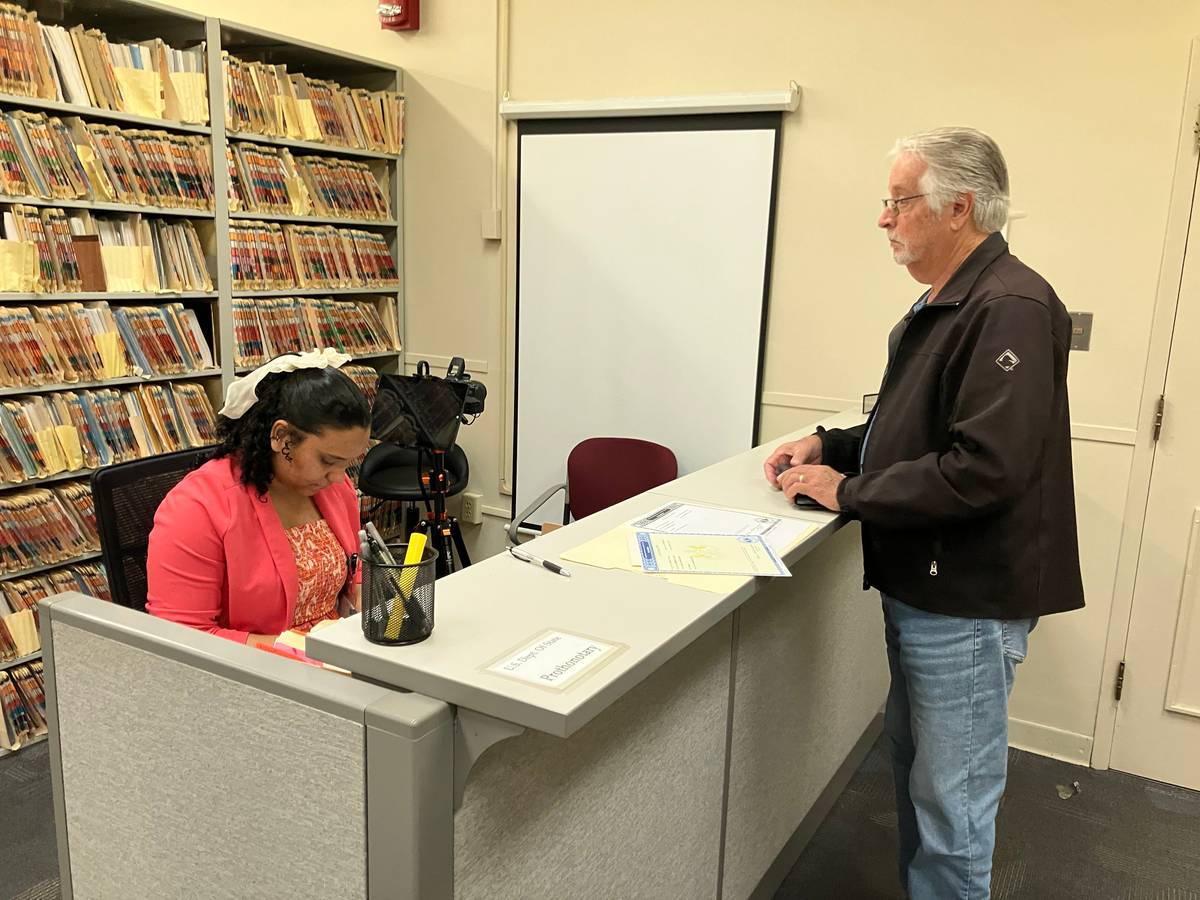

Dan Seaman, chief county assessor, said an appraisal conducted by a county-hired appraiser showed a valuation that was much closer to the one presented by Boscov’s to the county assessment board last October.

“The (county’s) appraisal was $6.26 million and theirs was $6.14, so they were within $120,000 of each other,” said Seaman. ”Their attorney talked to Boscov’s and they were willing to accept it (the $6.26 million appraisal figure).”

The settlement agreement between the county and the store chain on April 18 means that Boscov’s assessed value for the four properties is $4.5 million instead of $5.5 million. The assessed value of a property is determined by taking the current market valuation times the state’s common level ratio, which in Lebanon County is .719, according to Seaman.

“We (his office and the assessment board) talk about it, you know, what our appraisal came back at and that we’re not going to get any number higher than what our appraisal was going to be,” said Seaman. “They don’t really vote on it, but they agree to my office offering them the appraisal figure we received.”

The lowered assessed value drops tax receipts for Lebanon School District by $22,662, West Lebanon Township by $5,609, and Lebanon County by $3,970, according to Seaman. Seaman noted that the settlement is retroactive to Jan. 1 for the county and township while the school district’s new tax year starts July 1, adding the $22,662 figure is based on the school district’s 2022 tax millage rate.

“The district is naturally disappointed with the lower property reassessment,” wrote Kelly Herr, business manager of Lebanon School District, in an email to LebTown. “Any reduction in revenue chips away at our ability to provide a quality education and vital support services to our students.”

Other questions posed to Herr and school district officials via multiple emails went unanswered.

One question asked if the district uses a funding formula that includes a provision to address lower assessed values and, if so, how that works. They were also asked if no funding formula exists, how does the district recoup lost tax revenue when settlement agreements like this one occur.

Commissioner Jo Ellen Litz, chair of Lebanon County Assessment Board, said the county does not have its own funding formula mechanism that takes into consideration potential lost revenue from lowered assessed property values.

“There is no mechanism in place,” said Litz. “It’s something we have to bite the bullet and figure it out at the time after it happens. At $4,000, we are always able to make that work. If it were $4 million, we’d be in real trouble.”

Litz added that assessment appeals are rare in Lebanon County.

“It may happen one or two times a year,” said Litz. “It doesn’t happen a lot in Lebanon County because our property values tend to be lower than surrounding counties. We do have someone who occasionally goes the whole nine yards and will get a court ruling, but that’s rare.”

When presenting last October to assessment board officials, Boscov’s attorney and its appraiser shared property values from similar commercial properties in other Pennsylvania locations as part of its argument to lower the assessed values of those four properties.

Neither West Lebanon Township officials nor Boscov’s returned email requests for comment as of publication for this story.

Questions about this story? Suggestions for a future LebTown article? Reach our newsroom using this contact form and we’ll do our best to get back to you.

Build the future of local news.

Cancel anytime.

Monthly Subscription

🌟 Annual Subscription

- Still no paywall!

- Fewer ads

- Exclusive events and emails

- All monthly benefits

- Most popular option

- Make a bigger impact

Already a member? Log in here to hide these messages

Free local news isn’t cheap. If you value the coverage LebTown provides, help us make it sustainable. You can unlock more reporting for the community by joining as a monthly or annual member, or supporting our work with a one-time contribution. Cancel anytime.