Lebanon County Commissioners will consider making changes to the hotel tax grant program since its portion of the funding is nearly depleted.

The topic “Hotel Tax Grant Guidelines” is on today’s agenda at the commissioners’ biweekly meeting in room 207 of the county municipal building. The meeting, which is open to the public, begins at 9:30 a.m.

LebTown received a draft copy of the changes as part of a media packet of meeting materials and noted a major change to the Lebanon County Commissioners Hotel Tax Grant Program Guidelines.

The guideline previously stated: “Grant monies shall be used for promotion of events that attract tourists to eat and sleep in Lebanon County. Including evidence or event data that demonstrates this is strongly encouraged.”

The draft version of that paragraph now reads: “Grant monies shall be used for promotion of events that attract tourists to spend hotel stays or significant spending in Lebanon County. Application must include evidence, event data, or a narrative that demonstrates this.”

At their prior meeting on July 18, Wolgemuth informed commissioners that the fund was too low to fulfill the latest grant requests that had been received from three organizations that had upcoming events at Lebanon Valley Exposition Center.

Commissioners unanimously voted at that meeting, at the suggestion of chairman Robert Phillips, to “table the three funding requests until new guidelines were adopted and the fund was increased.”

Lebanon County treasurer Sallie Neuin told LebTown in a phone interview this week that the county’s hotel tax grant fund balance was around $8,300 and that the three funding requests that had been received totaled $17,500.

Wolgemuth had informed commissioners at various public meetings over the past several years that the county’s hotel tax grant program funding was continually headed downward.

In response to that information, commissioners first decided to lower the amount an applicant would potentially receive from a maximum of $10,000 to $7,500 and then eventually lessened it to $5,000.

Grants from the fund require a cash or in-kind local match of at least 25 percent, according to guidelines established by the county that reflect the state law that created the hotel tax grant program.

“As you’re all aware, the fund is down pretty low at this point. The amount you have in requests exceeds the amount you have available,” said Wolgemuth at the July 18 meeting. “At the same time, you’ve been talking about reconsidering the guidelines for these grants, so I have given you each a draft that changes a bit, doesn’t really change, it emphasizes more of a reservation/hotel use for these events.”

Neuin said her office collects the tax from Lebanon County hotels and deducts 4 percent of the funds collected on a monthly basis. It then distributes the balance to Visit Lebanon Valley (VLV), which is the county’s tourism agency. VLV keeps a portion of the funding and then provides a percentage of every dollar collected to the expo center and returns the county its share.

The current distribution ratio as established in Lebanon County’s Ordinance 54, which was created in 2016, provides 55 percent to Visit Lebanon Valley for the “purposes of tourism, promotion and tourism development.” Thirty-five percent goes to the Lebanon Valley Exposition Corporation for “tourism, convention promotion and tourism development” and 10 percent for Lebanon County for “maintaining special county tourism efforts.”

A request of officials for the total number of entities paying the 5-percent tax, which includes any residence that earns income from transient individuals or people seeking temporary room occupancy, had not been processed by the county treasurer’s office nor VLV as of publication.

LebTown had also requested from those same two agencies, but had not received as of publication, how much revenue was generated from the tax in 2021 through 2023 and the first six months of 2024. Taxed entities have until the 20th day of the following month to have their payments postmarked to the county treasurer’s office.

On July 18, Phillips said he favored revamping the ratio for the collection and disbursement of revenues for the hotel tax. Various county officials have told LebTown that the purpose of the hotel tax grant program is to “put heads in beds.”

VLV has argued that heads in beds is only part of the tourism strategy.

“To get overnight stays, we need to highlight our unique events, things to do, local shops and eateries,” it said in a fact sheet distributed to LebTown. “Visitor spending is related to all of these factors.”

Phillips also said he had mentioned several months ago the possibility of changing the funding allocation to give the county a little bit more money to distribute to its applicants.

“Visit Lebanon Valley has the lion’s share of the percentage, they get 55 percent of the hotel tax, the expo, with over 200 venues (events) is a great generator of the hotel tax, gets 35 percent, and then the county gets 10,” said Phillips. “In my reallocation thinking, was to move the expo to 45 percent, the VLV to 40 percent and the county’s, for our consideration, up to 15 percent.”

Phillips said that since VLV has established a cash surplus, it could absorb a change in allocation ratio. The expo center, for its part, has also built up its own cash surplus.

Phililps noted the new guidelines combined with a reallocation of funds would allow the county to honor or at least consider more requests, which have already been steadily increasing from a plethora of county-based organizations and many outside of the area who sponsor events at the expo center.

While commissioners may alter the guidelines at today’s meeting, they will not take any action at this time to revamp the distribution percentages, according to county solicitor Matt Bugli. Bugli said that action would require changes to Ordinance 54, which would necessitate a process that includes publicly advertising the proposed changes.

Phillips told LebTown on Wednesday he was not ready to consider altering the distribution percentages since he needed to discuss any possible percentile modifications with Commissioner Mike Kuhn, who represents the county on VLV’s board of directors.

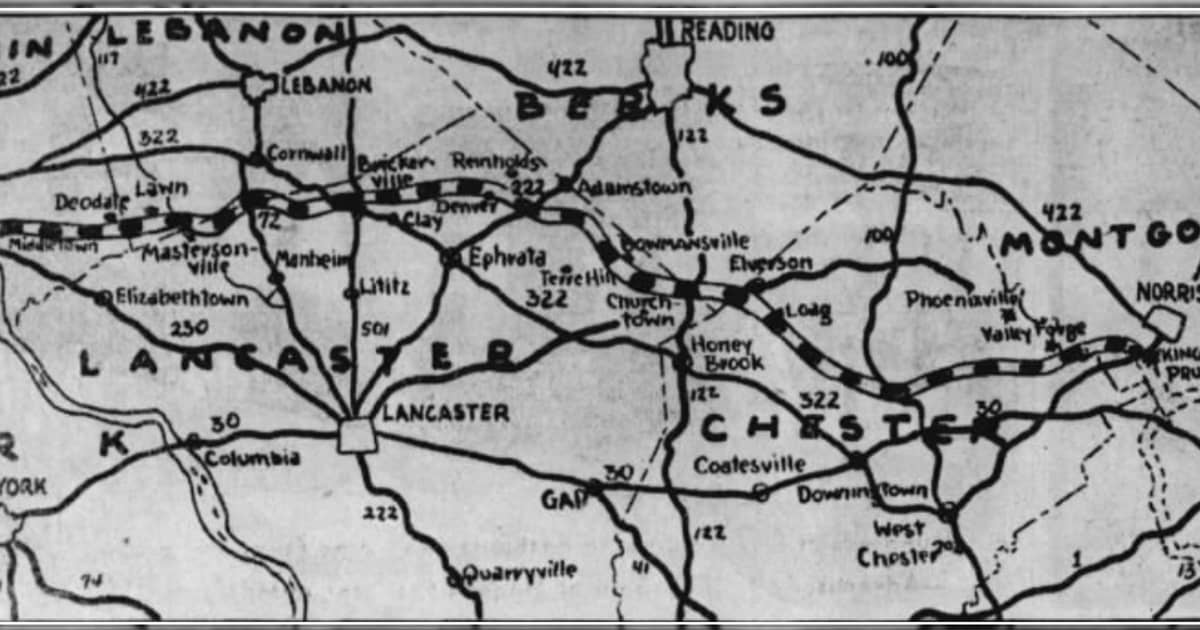

VLV president Jen Kuzo told LebTown that her agency receives the lowest amount of funding when compared to the other seven fifth-class counties in Pennsylvania. Pennsylvania counties are placed in classes based on population size, with fifth-class counties designated as those with populations of 95,000 to 149,999 residents.

“Visit Lebanon Valley receives the lowest percentage of hotel tax at 51 percent when compared to the other six fifth-class counties,” said Kuzo. “Their destination marketing organizations, or as we call them DMOs, the average percent they receive of the hotel tax is 84 percent. When you look at all 67 counties in Pennsylvania regarding the percentage of the hotel tax that they receive so that they can do their jobs, Visit Lebanon Valley is in the bottom 22 percent of the state. We receive the smallest amount of hotel tax to do our jobs.”

Kuzo said VLV’s job is to strengthen Lebanon Valley’s economy through tourism.

“Our focus is to market, advertise and promote our county’s highlights to encourage support of local businesses, attractions and overnight stays,” she said. “We want to collaborate with our community to promote the Lebanon Valley as a lively place to visit, live, work and play.”

Questions about this story? Suggestions for a future LebTown article? Reach our newsroom using this contact form and we’ll do our best to get back to you.

Keep local news strong.

Cancel anytime.

Monthly Subscription

🌟 Annual Subscription

- Still no paywall!

- Fewer ads

- Exclusive events and emails

- All monthly benefits

- Most popular option

- Make a bigger impact

Already a member? Log in here to hide these messages

Free local news isn’t cheap. If you value the coverage LebTown provides, help us make it sustainable. You can unlock more reporting for the community by joining as a monthly or annual member, or supporting our work with a one-time contribution. Cancel anytime.