State Senator Chris Gebhard is pushing for a constitutional amendment abolishing school property taxes in Pennsylvania.

The amendment, if approved by the General Assembly, would go before the voters as a ballot question before it could be enacted. As written, the bill wants to “prohibit school districts from collecting property taxes beginning on July 1, 2029,” according to a press release issued jointly on July 15 by the offices of Gebhard and state Senator Doug Mastriano (R-33), who is a co-sponsor of the bill.

Gebhard, a Republican whose 48th district covers Lebanon County and parts of Lancaster and Berks counties, is the prime sponsor on Senate Bill 929, which is defined on the state Legislature’s website as a joint resolution “proposing an amendment to the Constitution of the Commonwealth of Pennsylvania, providing for expiration of authority to levy or collect real property taxes.”

“It is outrageous and unacceptable that property taxes are causing Pennsylvanians to lose their homes,” Gebhard said in a statement. “We must act now to end the suffering so many people are facing because their property tax bills keep going up. The people of Pennsylvania deserve to have a direct voice on this issue, which is why we introduced this bill as a constitutional amendment, putting the final decision on property tax elimination in the hands of the voters. Homeownership is a long-term goal for countless Pennsylvanians who are striving to achieve the American Dream. No tax should ever lead to our residents having to face homelessness.”

The press release calls the school property tax “burdensome.”

Besides Mastriano, co-sponsors of the bill as of July 18 are Republican senators David Argall, Tracy Pennycuick, Kristin Phillips-Hill, Rosemary Brown, Patrick Stefano, Camera Bartolotta, and Jarrett Coleman, and Democratic senators Lisa Boscola and Judith Schwank.

“It is ludicrous that Pennsylvanians are being forced to pay rent — disguised as property taxes — on land they own,” Mastriano said in the release. “This must end. Now.”

Alternative revenue sources

According to the release, the General Assembly “would be required to find alternative methods to fund Pennsylvania’s public school system.” No specific proposal for funding public schools in the commonwealth has been made public at this time.

The draft resolution on the state Legislature’s website states that the General Assembly “shall, by general law, provide annually each school district with maintenance and support in an amount at least equal to the real property tax collected by the school district on real property during the fiscal year ending June 30, 2029, less the annual debt service legally obligated to be paid by the school district during the fiscal year ending June 30, 2029.”

The source of future school funding, the draft resolution says, “may include” a state retail tax on personal property or services, a state income tax, and a local income tax.

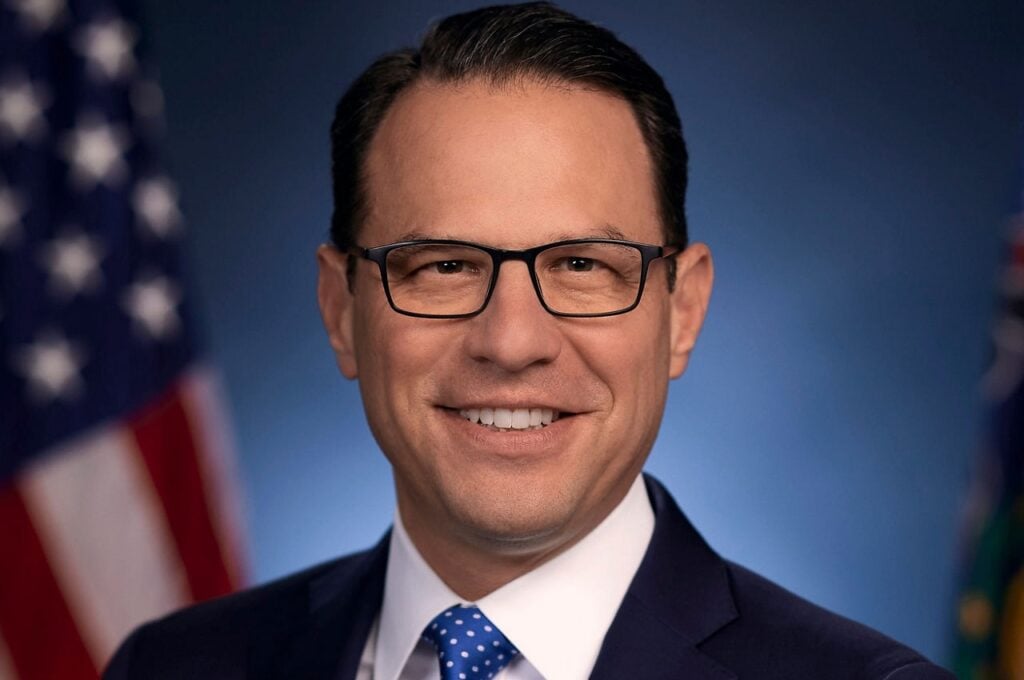

A spokesman for Gov. Josh Shapiro told LebTown on Friday that the governor is “keeping an eye” on the proposed amendment.

“The governor’s office is going to be reviewing this as it moves through the legislative process,” Shapiro’s press secretary Manuel Bonder said in a telephone interview Friday morning.

Shapiro’s administration has in recent years expanded the state’s Property Tax/Rent Rebate program, which offers some tax relief to qualifying property owners.

The release from Gebhard and Mastriano says Pennsylvania homeowners “are struggling to keep their homes due to increasing school property taxes.”

“Each year, thousands of our seniors — men and women who worked their entire lives, paid off their homes and played by the rules — are being thrown out of those very homes simply because they can’t keep up with an ever-growing tax bill. This is not just a financial issue — it’s a moral crisis. When it comes down to a choice between paying for insulin or paying the government to stay in your own home, something in our system is broken. If you own your land, why should you have to pay the government every year for the right to keep what is already yours?” Mastriano said in the release.

“I’m proud to stand shoulder to shoulder with Senator Gebhard on this legislation — because enough is enough,” he added. “It’s time we stop punishing homeowners for owning a piece of the American dream. We will not rest until this burden is lifted and justice is restored for our retirees, our families and all those who simply want to live in peace in the homes they rightfully own.”

According to the joint statement, the proposed amendment must be approved by both houses of the General Assembly “during two consecutive legislative sessions,” after which Pennsylvania voters will decide the issue via a “yes/no” question on the ballot. “If everything previously mentioned happened, the earliest it could become law would be 2028 with a likely effective date a year later,” Urban said.

Pass now, fund later

Gebhard’s chief of staff, Matthew J. Urban, told LebTown in an email Friday that the proposal is “a complicated topic.”

“To be clear,” Urban said, Gebhard’s proposal “does not delineate any alternative funding source – and that is intentional.”

He said the bill owe’s its origins to two pillars. “First, the decades and decades of talk about serious property tax reduction or elimination without any real progress,” Urban explained in the email. “Second, a Feb 2023 Pennsylvania Commonwealth Court directive stating that the (current) public-school funding system is inherently unconstitutional. There has been no action on that directive for the last two years.”

Other proposals to do away with the property tax over the last quarter-century have been “met with overwhelming initial support,” Urban said. “The gridlock and delay always occurs due to there being much debate and disagreement on the details of the new funding source.” In this case, he said, “Gebhard’s idea is to get something passed on the part that everyone agrees upon and establishes a hard date in which the General Assembly must come up with a plan because the current funding source will cease.”

So, although there is no mandate in Gebhard’s bill directing how the funding formula should change, Urban said some recent proposals include a bill by state Rep. Wendy Fink (R-94) that would increase the state sales tax from 6% to 8%, with the additional 2% being paid to the counties to distribute to local school districts. (“That new 2% would also be on previously exempt items such as food and clothing,” Urban noted.)

Fink’s bill also proposes increasing the personal income tax in Pennsylvania from 3.07% to 4.92%, with the additional 1.85% also going to schools. She also proposes expanding the personal income tax to include retirement income, with exemptions for Social Security, employee contributions in pension and defined contribution plans, and military pension or survivor benefit payments.

Other suggestions, Urban said, include raising revenues from gaming, alcohol, and cigarettes sales, as well as replacing property taxes with a local earned income tax, imposing a bracketed personal income tax for higher income earners, or increasing the corporate net income tax. (The latter suggestion isn’t likely, Urban said, since a bipartisan bill was passed in Harrisburg in 2024 reducing the corporate tax rate from 9.99% to 4.99% by 2031.)

“I am sure all these and more will be part of the conversation if property tax elimination would become law,” he said. “As you stated, there have been decades of talk about serious property tax reduction or elimination without any real progress.”

The task ahead for Gebhard and his co-sponsors is building enough bipartisan support to move the bill through the General Assembly – twice – and onto the governor’s desk, Urban said. Proponents of the measure believe the Commonwealth Court decision in 2023, “coupled with the idea of letting the people of Pennsylvania decide at the ballot box how they want education funded …will be driving factors to move this bill forward,” he said.

States looking at options

According to a 2024 report from Education Week, local property taxes remain “one of the biggest sources of K-12 school funding” in every state, accounting for more than a third of public school spending. However, the article noted, “a handful” of states are looking at the option “to abandon property taxes altogether, or at least as a funding source for schools.”

“Homeowners want smaller bills. Education advocates, meanwhile, have long criticized the K-12 system’s reliance on property taxes, which disproportionately burden residents of low-income areas, exacerbate socioeconomic gaps between white and Black families, and are often derived from faulty or outdated valuations that end up contested in court,” the article by Mark Lieberman explains.

“But zeroing out property tax collections altogether would be a dramatic step without precedent, finance experts say. Short-term ramifications, like wresting control over raising revenue away from local school districts, would almost certainly be controversial. And some of the far-reaching consequences are virtually impossible to predict.”

School revenue from property taxes varies among states, the article notes. The percentage of public school revenue from property taxes in the 2020-2021 school year, according to information provided by the National Center for Education Statistics is 50% in New York, 46% in Maine, 39% in Florida, 27% in California, and 24% in Maryland. In Pennsylvania that year, 43% of school funding came from property taxes.

“America’s been taxing property for the entirety of its history,” David Schleicher, a professor of property and urban law at Yale University who researches property taxes and other municipal finance issues, told Lieberman, who noted that the concept of property taxes “dates back to ancient Mesopotamia, when the Ur dynasty collected goods from locals to pay for building projects.”

Lieberman notes that the notion to eliminate property taxes “hasn’t gotten far” in the past. For instance, he says, “more than three-quarters of North Dakota voters in 2012 rejected a proposal to eliminate property taxes. A similar legislative proposal in Pennsylvania fell short by the thinnest of margins in 2016.”

However, according to the article, tax experts say replacing property taxes with steeper sales taxes could be just as inequitable, because low-income families tend to pay a much higher percentage of their income in sales taxes than high-income families. Rita Jefferson, a local policy analyst for the Institute on Taxation and Economic Policy, told Lieberman that school districts are “super reliant” on a system that says, “if you can afford to live in our district, you can afford to go to our schools.”

The article also notes “that property tax revenues tend to be relatively stable from one year to the next. State funding, by contrast, can vary greatly depending on the strength of the economy and politicians’ priorities.

“That would be even more true if school funding came exclusively from sales and income taxes. Sales tax collections plummeted, for instance, in the early days of the pandemic. Without the property tax base, districts would have immediately suffered.”

Questions about this story? Suggestions for a future LebTown article? Reach our newsroom using this contact form and we’ll do our best to get back to you.

Keep local news strong.

Cancel anytime.

Monthly Subscription

🌟 Annual Subscription

- Still no paywall!

- Fewer ads

- Exclusive events and emails

- All monthly benefits

- Most popular option

- Make a bigger impact

Already a member? Log in here to hide these messages

An informed community is a stronger community. LebTown covers the local government meetings, breaking news, and community stories that shape Lebanon County’s future. Help us expand our coverage by becoming a monthly or annual member, or support our work with a one-time contribution. Cancel anytime.