This article was funded by LebTown donors as part of our Civic Impact Reporting Project.

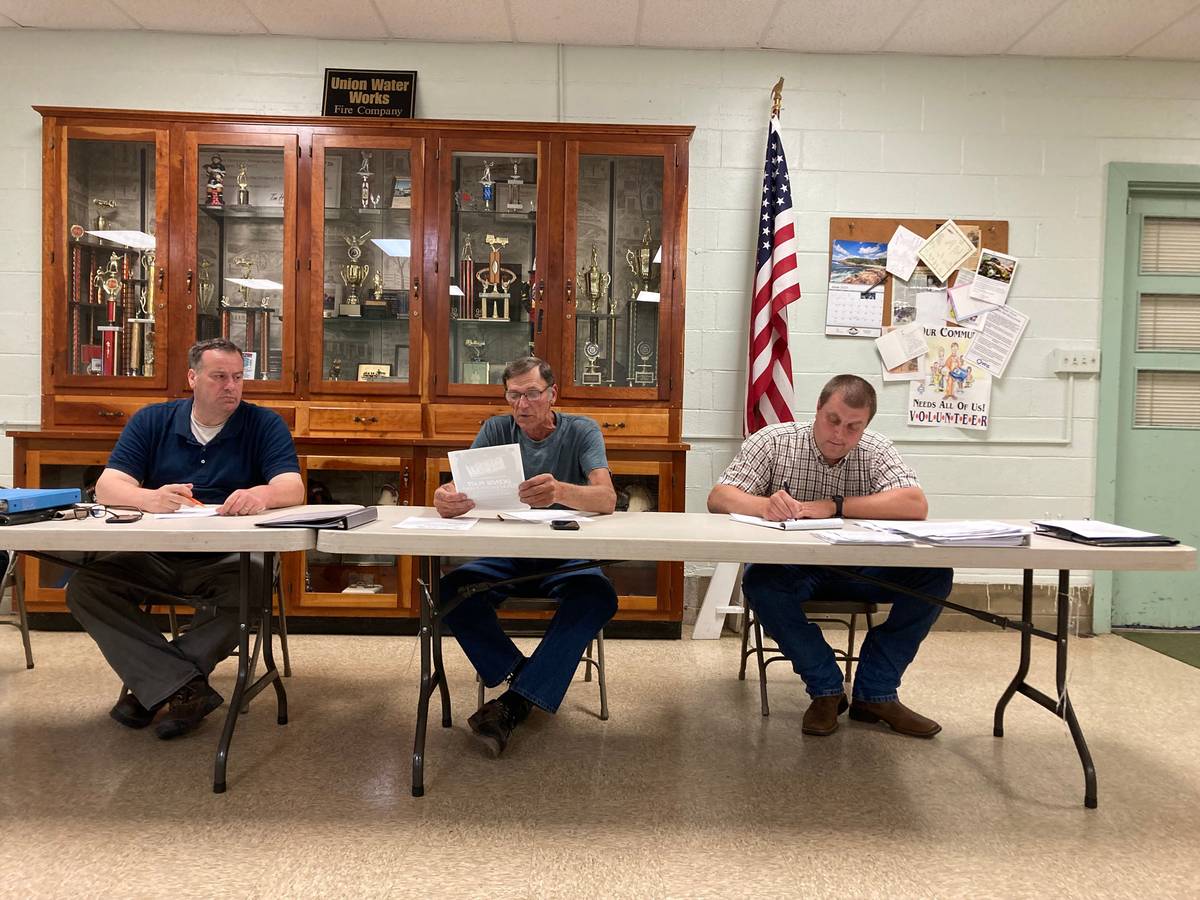

North Annville Township supervisors on Monday unanimously approved creating a 1-mill fire service tax as part of their 2026 budget for the purchase of fire apparatus for North Annville Fire Department.

The median assessed value of a home in North Annville Township in 2024 was approximately $188,400, meaning the average homeowner will pay an additional $188.40 in taxes in 2026. Township supervisor Adam Wolfe said there are 987 taxable properties in the municipality.

The tax, the first-ever for the municipality, comes with some contingencies. The tax expires on Dec. 31, 2028, and any potential renewal of the tax at that time would have to receive a majority vote of township supervisors. It also can be revoked by an unanimous vote of the supervisors at a public session of the board prior to its expiration date.

The resolution allows supervisors to levy a special tax upon real property within the township for the “purchase of fire apparatus and other fire protection equipment, the maintaining of the apparatus, the housing of the apparatus, the contracting of fire services and the like, and to assess the tax by an equal assessment upon all benefitted properties.”

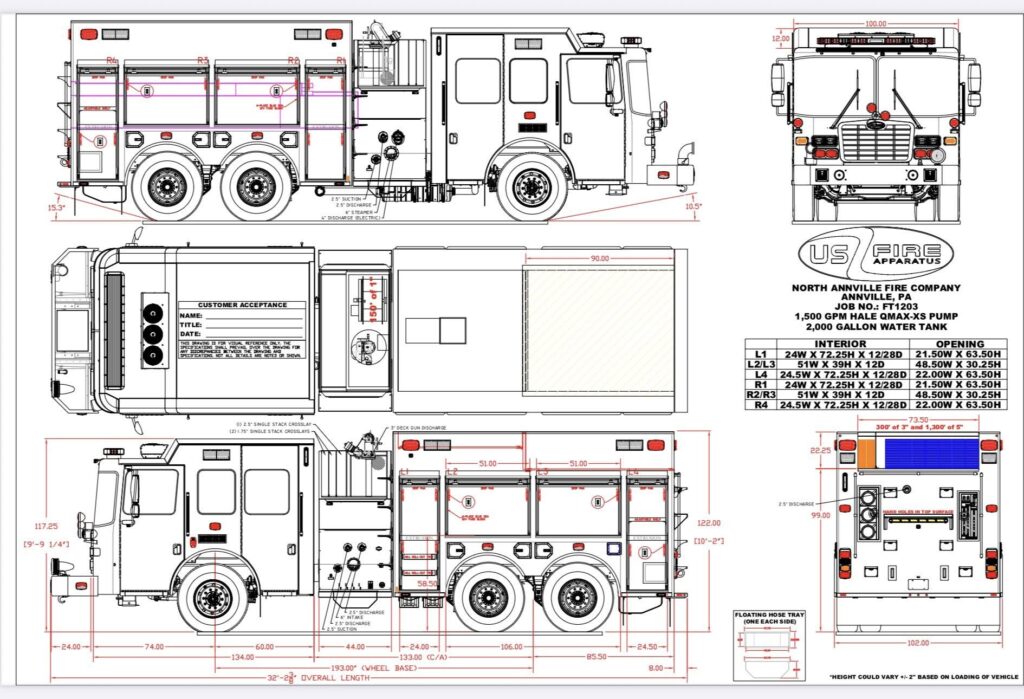

It was noted, however, that the tax is exclusively for the purchase of a new replacement fire engine. The township is splitting the cost with the fire company for an engine that will cost an estimated $1.2 million.

“These trucks have tripled in price since COVID,” said chairman Clyde Myers during nearly 50 minutes of discussion that became boisterous at times between township residents who opposed the tax being approved and fire company representatives. Several times the audience had to be told to address their comments to Myers and not each other.

At prior meetings and following the recent merger of Bellegrove and Union Water Works fire companies, company officials told supervisors that some pieces of equipment had outlived their usefulness. Over the course many months and six iterations, the township and fire company finally agreed to a vehicle consolidation plan.

Further exacerbating the situation is the inability to obtain replacement parts for equipment that is obsolete since those vehicles are at least 25 years old. One farmer, who spoke against the proposal, said they must repair their farm equipment that is as old as the fire trucks if not older, and fire personnel should do the same.

He also noted, as did his wife, that farmers are at the breaking point and don’t have the financial resources to pay the tax.

North Annville is the last organized municipality in Lebanon County to create a tax millage rate, meaning the township’s budget is set primarily via earned income and real estate transfer taxes. (Cold Spring Township, which has no government, also has no property tax.)

Under Fire Service Capital Fund, the account will receive $225,000 following the creation of a 1-mill real estate tax to help fund the fire company, which was formed Jan. 1 following the merger of Bellegrove and Union Water Works fire companies into the North Annville Fire Company. Last December, company officials said they planned to buy a new fire engine once they were operational and had the appropriate funds.

Read More: Bellegrove and Union Water Works merge on Jan. 1 into N. Annville Fire Department

A large portion of the township’s disbursements for next year is for the fire company, totaling $785,000 to help fund public safety and a fire service loan repayment of $228,500, for total expenditures of just over $1 million of an expected overall budget of $1.7 million.

The new tax revenue, interest, a capital equipment loan, and an existing $220,000 in the fire service’s fund as of Jan. 1, will leave a balance of just over $1 million after expected receipts. Minus the expenditures, the township’s fire service fund is expected to be $20,000 at the close of 2026.

Another township resident said the two former companies own four buildings between them and that selling property would generate enough revenue to offset the cost of a new vehicle. The resident also said the township should join forces with other companies and become regionalized.

Fire company vehicle and other consolidation efforts are in the works, officials announced. However, the vehicle has been ordered, and the revenue is needed now to pay for it.

Volunteer firefighter James Hoffman, who is also a farmer, spoke passionately about preserving the fire company, saying that without the company the township residents would pay more for regional service.

“You’re going to give the buildings and the apparatus and everything to them, lock, stock and barrel. And then you know what they’re going to do? They’re going to give you a darn bill,” said Hoffman. “After you gave them everything you had, everything we had, both our departments, all the trucks, all the money in the bank, just goes right to them and that’s it, and we’re not far from them. Goes right over to the regional operation. And when they have it, before they even have the stuff tucked in the garage, you get a bill every month. You have no say.”

Another township resident asked supervisors to assess the tax via the earned income tax. However, supervisors are not permitted by law to charge more than the state maximum of one half of 1 percent, which is the current rate in the township.

There was also discussion about possibly awarding a fire services grant, which was put in limbo during the recent state budget impasse. If North Annville Township receives the grant, it’s possible the fire tax would be rescinded.

The farmer’s wife asked supervisors to wait until it’s determined if the grant is awarded before instituting the tax, but officials said the equipment has already been ordered to lock in pricing.

2026 budget approved

The projected 2026 budget that was presented last month via the first reading passed unanimously with an expected balance of $800,000 in the township’s general fund on Jan. 1, anticipated revenues of $570,770 next year, and expenditures totaling $544,032, leaving a Dec. 31, 2026, expected balance in the general fund of $826,738.

The beginning balance of all township funds totals $1.83 million with expected receipts for all funds of $1.55 million and disbursements totaling $1.70 million, leaving an end balance on Dec. 31, 2025, for all funds of $1.69 million.

Other township business

In other business, supervisors voted unanimously to:

- Renew the police services contract with Cleona Borough for three years through 2028 at the following rates: $102,000 in 2026, $108,000 in 2027, and $114,000 in 2028.

- Hire an independent sewer engineer to be involved with Lebanon Valley College’s lot grading project for plan review and onsite inspections until it is completed.

- Grant a subdivision plan for Daniel Kreider on two acres on Mill Street.

- Provide a partial earned income tax credit to 27 local volunteer fire company members who completed the requirements to qualify for the relief program.

- Take two actions regarding ongoing nuisance violations. In the one case, supervisors will give the owner of 435 Kauffman Road a letter stating he’s in violation of zoning ordinance 5.18 regarding vehicles. The ordinance states automotive vehicles, trailers, and recreational vehicles and boats cannot be parked or stored in any street or in the front yard of a property. The second letter is being sent to a homeowner at 1693 N. Route 934 to address an ongoing issue with too many boats and other vehicles on that lot with a completion date of Jan. 12.

- Provide a letter to homeowners in violation of on-lot disposal system pumping program regulations. The individuals will be informed they must be compliant within 30 days or the township will take corrective action against them.

- Announce the 2026 meeting schedule for supervisors and the planning commission.

- Renew for 2026 an agreement with the Humane Society to house stray dogs picked up in the township. There were two dogs in 2025, so the township will pay the shelter $100 since the housing acceptance rate is $50 per dog.

- Approve the Nov. 10 meeting minutes, treasurer’s report and monthly bills.

Next meeting

The North Annville Township supervisors meet the second Monday of the month at 7:30 p.m. in Union Water Works Social Hall, 2875 Water Works Way, Annville. Supervisors will hold their annual reorganizational meeting on Monday Jan. 5, at 6:30 p.m.

Questions about this story? Suggestions for a future LebTown article? Reach our newsroom using this contact form and we’ll do our best to get back to you.

Be part of Lebanon County’s story.

Cancel anytime.

Monthly Subscription

🌟 Annual Subscription

- Still no paywall!

- Fewer ads

- Exclusive events and emails

- All monthly benefits

- Most popular option

- Make a bigger impact

Already a member? Log in here to hide these messages

Strong communities need someone keeping an eye on local institutions. LebTown holds leaders accountable, reports on decisions affecting your taxes and schools, and ensures transparency at every level. Support this work with a monthly or annual membership, or make a one-time contribution. Cancel anytime.