When the Federal Highway Administration sited an interchange for I-81 in Union Township in the 1960s, the internet was yet to be conceived, a mouse was a pesky critter — and Jeff Bezos was 4 years old.

Today, that interchange is bustling with tractor-trailers moving goods from nearby warehouses and distribution centers to East Coast businesses and consumers. Loaded with products from toys and chocolate to electronics and specialty tools and equipment, the trucks take I-81 north for the Northeast.

Or they merge onto I-78 east for Elizabeth, New Jersey, the largest port on the East Coast.

Savvy real estate investors recognized the potential for e-commerce and Pennsylvania’s nexus of east-west interstates. Starting in the Lehigh Valley, they created freight nodes of warehouses and distribution centers to meet both consumers’ demands for goods and the supply chain needs of businesses and industries.

As land near interchanges was developed or redeveloped, investors began shifting away from municipal areas and into more rural areas — including Lebanon County. Logistics parks have become more common as have the trucks moving the goods from the warehouses and distribution centers within those parks.

In the county’s 2007 comprehensive plan, movement of goods by trucks was nary a blip on the radar.

“This is one of the fastest-growing freight corridors in the state,” said Jon Fitzkee, assistant director and senior transportation planner with the county planning department. “We have seen that growth in Union and Bethel townships in Lebanon County given their proximity to I-81/I-78 and nearby interchanges — and now we’re seeing it in the rest of the county.”

Location, location, location

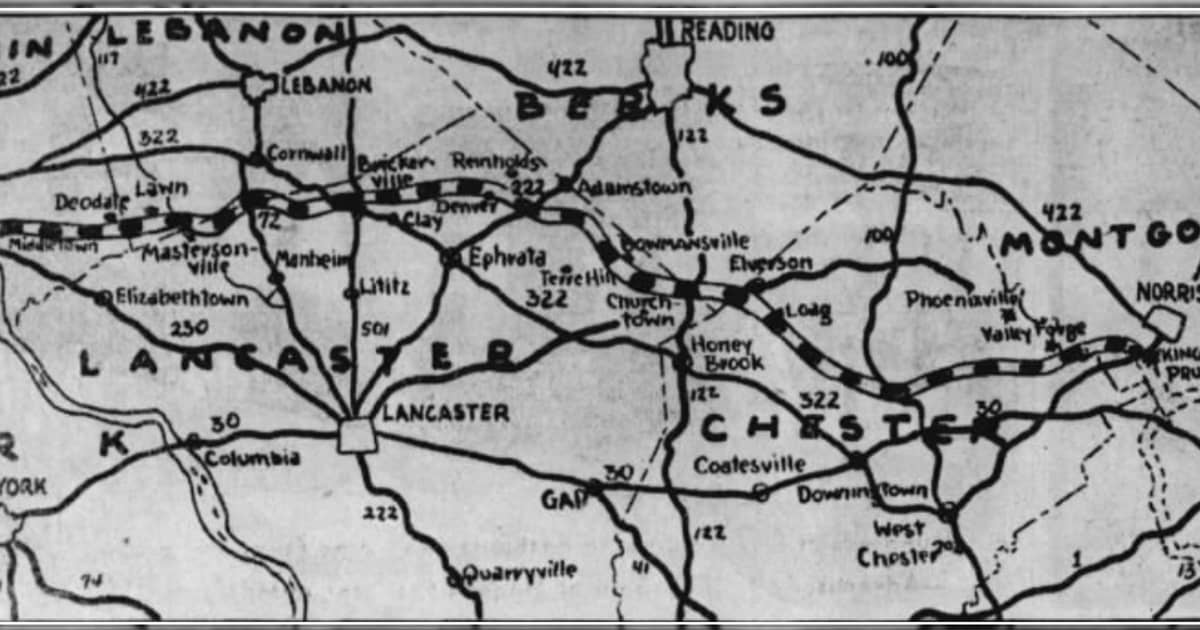

Lebanon County has two interchanges providing access to I-81, one at Route 72 and Fisher Avenue just outside of Fort Indiantown Gap in Union Township and the other at Route 934 in East Hanover Township, also on the edge of the National Guard training facility.

The two interchanges are a study in contrasts.

In Union Township, the interchange sits smack in the middle of a commercial zone. A Love’s travel center with McDonald’s anchors one corner with a Wendy’s across the four-lane Fisher Avenue. Nearby are Chester’s Chicken, several hotels, auto repair and truck service businesses and gas stations.

South of the interchange on 235 acres zoned industrial is Logistics Park, a development of 13 warehouses and distribution centers. Most are 400,000 to 500,000 square feet, said township engineer Brent McFeaters.

Some of the buildings boast household names, such as Mattel and Georgia Pacific, and deliver products directly to consumers. Others have unfamiliar names that provide little clue as to what goes in and out of them. These are likely third-party logistics companies that manage inventories and warehouses for multiple businesses.

West of the interchange off Fisher Avenue are additional warehouses and centers. The trucking company Swift Transportation-Jonestown Terminal and an electronics equipment distributor are located north of the interchange and Fisher Avenue.

Altogether, about 85 percent or 635 acres of the township’s 750 industrial acres have been developed, McFeaters said.

In 2019, prompted by recurring accidents at Fisher Avenue and the I-81 interchange, the township began upgrading the intersection by installing new turning lanes and improved traffic signals. That project took more than four years to complete at a cost of $430,000, of which the township provided about $170,000 — even though both are state roads, McFeaters noted.

Even so, the Fisher Avenue/I-81 interchange has the county’s “highest user congestion cost” as measured by lost travel time, incidents of road rage, and increased air pollution, according to the Lebanon County Metropolitan Planning Organization’s draft long-range transportation plan.

Unlike the I-81 interchange in Union Township, the one in East Hanover Township is largely a landscape of grass and trees — fitting for a rural, agricultural township.

The interchange is in the township’s limited industrial district, which permits warehouses provided they are 100,000 square feet or less of gross floor area, according to a township zoning ordinance. By comparison, DHL Supply Chain’s warehouse on Route 422 in South Annville Township has a footprint of 3 million square feet.

If the size limitation in the limited industrial district doesn’t discourage potential developers, the lack of public water might.

“We frequently get inquiries from developers, but there’s nothing actually moving forward,” said township manager Erik Harmon.

While Bethel Township doesn’t have access to I-81, it does have access to I-78 east, and developers have taken note. The township’s C-2 highway commercial zone, which lists warehouses as a permitted use, has a mix of chicken processing plants and distribution centers.

“No new warehouses have come in since I’ve been in the position — just additions to existing tenants or changes of tenants,” said Jaclyn Hollenbach, who’s been Bethel Township zoning officer for less than a year.

Two parcels on either side of Route 22 are what remains undeveloped in the highway commercial zone, she added.

With available land zoned for large warehouses and distribution centers in the county’s northern tier about maxed out, developers have sought locations elsewhere in the county — and that has put tractor-trailers on two-lane country roads as they head to interstates.

Warehouses and traffic

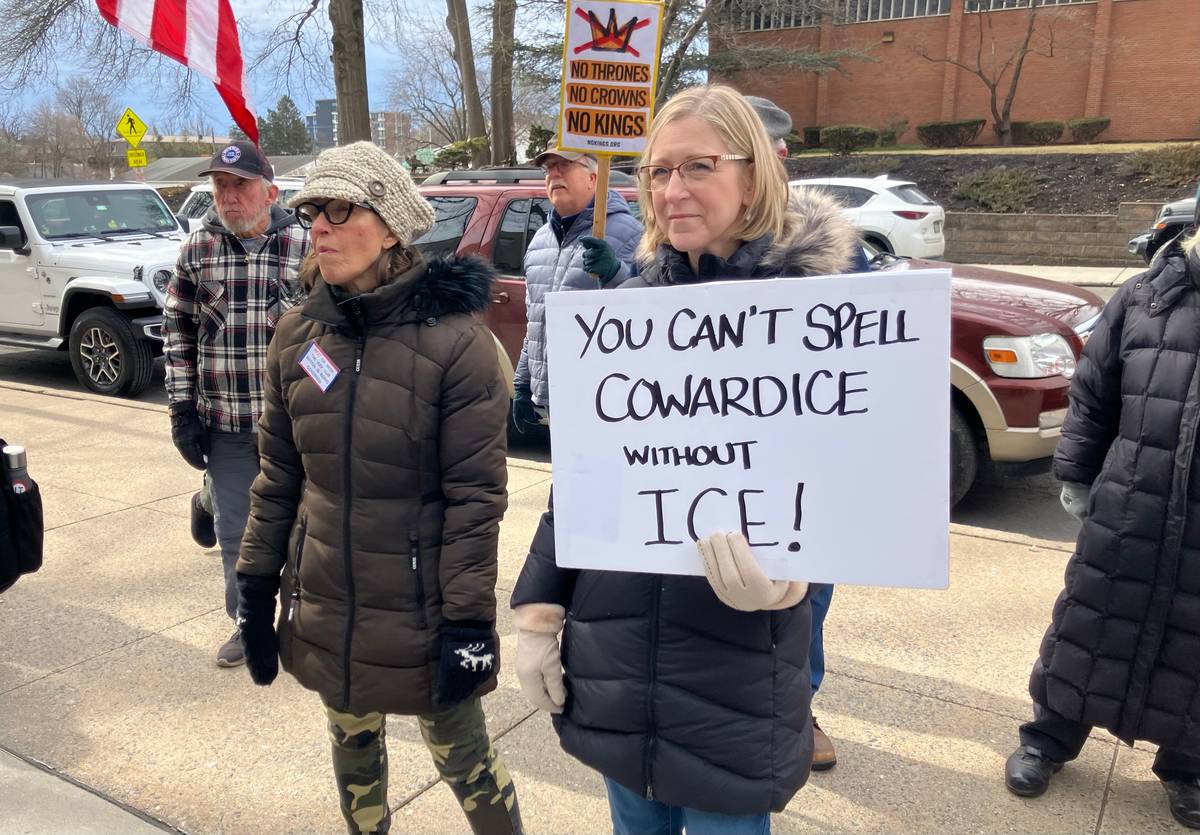

At two public meetings this year for the county’s updated long-range transportation plan — to be adopted this month — residents expressed concerns about increased truck traffic related to the growing number of warehouses.

While the report notes truck traffic is highest “along key corridors within the county” — namely, interstates 76, 78 and 81 — it also singles out several county roads. One road flagged by residents for increased truck traffic was Route 419 in Cornwall Borough that is used by trucks from the industrial park and the DHL facility, both on State Drive.

If bound for I-76, truckers must navigate a tight right turn at the intersection at Boyd Street, and that can create a bottleneck, said borough manager Cody Rhoads. About a mile further, another backup often occurs at the intersection of Quentin Road/SR 72 in West Cornwall Township, said Russ Gibble, supervisor chair, at a recent meeting.

That congestion has led the MPO to include a corridor study of SR 72, Cornwall Road and SR 410 in its 2025-28 Transportation Improvement Program.

As noted in the report, the county’s two-lane roads were not built for today’s burgeoning freight industry. Etched into the countryside decades if not centuries ago, the county’s rural roads once connected communities too small to be considered towns. Houses, churches and utilities border on the roads, which often have curves, hills and limited shoulders — all difficult for trucks.

And pavement compositions typically aren’t adequate for trucks with heavy loads, causing greater and more rapid deterioration of road surfaces, according to the draft of the long-range transportation plan. That, in turn, ups maintenance needs and costs.

Improving the county’s rural roads to accommodate more vehicular traffic may take novel fixes.

DHL, for instance, has proposed constructing a roundabout at SR 934 and Clear Spring Road in North Annville Township. The roundabout will allow trucks bound for I-81 from DHL’s Clear Springs Logistics Park in South Annville easier and safer access onto Route 934. With a roundabout, trucks also can avoid going into the center of Annville.

Read More: Lebanon County officials and municipal leaders gather to discuss local issues

But DHL doesn’t own any property around the proposed roundabout and has no power of eminent domain to acquire property. Additionally, while DHL has received a $3 million award from PennDOT’s Multi-Modal Transportation Fund for the project, DHL must carry out all the pre-construction work — preliminary engineering, final design, right-of-way, utilities — prior to drawing on any state funds, Fitzkee said.

“DHL is working to finetune a roundabout design that takes into account all current and future roadway users and aims to keep as much of the project in the public rights-of-way,” Fitzkee said. “If the project meets all the state’s requirements, PennDOT will give it a thumbs up.”

‘If you bought it, a truck brought it’

In 2021, Lebanon County’s MPO joined the Eastern Pennsylvania Freight Alliance, a consortium of nine counties experiencing rapid growth of logistics parks.

Read More: Freight movement through 10-county region will be studied in 2022

That alliance was started as members recognized that when trucks cross a county line, the problems cross with them, said Stephen Chiaramonte, a self-described “freight nerd” and vice president of WSP, lead consultant for the Eastern Pennsylvania Freight Infrastructure Plan.

Development of logistic parks in Lebanon County, the westernmost county in the alliance, has been slower compared to what Chiaramonte called the “staggering pace” in nearby Berks, Lehigh and Northampton counties. But the shift from Lebanon’s highway corridors to areas less proximate to the interstates is notable.

With e-commerce booming, the demand for warehouse space likely will continue — especially as about 40 percent of the nation’s consumers live within a day’s drive of eastern Pennsylvania, said Chiaramonte citing census data.

To address the impacts of freight traffic within the 10-county region, the Eastern Pennsylvania Freight Alliance is drafting a blueprint for future investments and policies to mitigate those impacts. Rail and air are considered, but the major focus is on improving the movement of goods by trucks because, as Chiaramonte quipped, “if you bought it, a truck brought it.”

“We’re looking at short-, mid- and long-term improvements,” he added. “There are not many examples of multi-MPO coordination in Pennsylvania and in the Northeast. It is rare to have this many agencies come together with a focused and united approach to a transportation challenge.”

Putting the brakes on?

What may put the brakes on additional warehouses and distribution centers in the county is neither available land zoned appropriately nor concerns about truck traffic — but available workers for the jobs.

“We have a finite number of individuals in the county who want to work and who can work, and you have a distribution center that might need 500-800 employees,” said Karen Groh, president & CEO of the Lebanon Valley Chamber of Commerce. “If we continue to add distribution centers, our population is not growing fast enough to meet that demand.”

Furthermore, depending upon where the facilities are located, getting to them can be a challenge as “it’s almost impossible for Lebanon Transit to cover all the shifts,” she added.

Unknown is whether robotic technologies might change how goods are delivered or create different workforce needs. Who knew 30 years ago that one could order a car online and have it delivered the next day, as Chiaramonte said.

Readers might remember a survey open from August 2023 to January 2024 asking residents for their concerns about and perceptions of the impacts of the freight industry. That survey was created by the freight alliance.

Respondents generally found warehouses undesirable — they didn’t like the visible presence of either the buildings or trucks, Chiaramonte said.

“We love having access to lots of things, but the tradeoff for convenience and pace of delivery is buildings and trucks,” Chiaramonte said.

South Annville Township warehouse park

Nearly 3 million square feet of warehouse space has opened in South Annville Township, with another 2.5 million square feet already planned. All three projects in the park received tax abatements under the Local Economic Revitalization Tax Assistance Act.

Read More: Your guide to the warehouses under construction in South Annville Twp.

NorthPoint Development’s EaglePoint Logistics Center

The EaglePoint facility consists of a single 1.1 million-square-foot warehouse that can later be expand to 1.3 million square feet. All 1.1 million square feet are currently listed as for lease on the company’s website.

The land for the EaglePoint facility was acquired by NorthPoint Development from MFS for just over $12 million in December 2021. NorthPoint Development has estimated total project costs to be $103 million.

The Hershey Company’s Annville Fulfillment Center

Hershey bought its 90-acre site from MFS in June 2019 for $9.2 million. Groundbreaking for the project took place in July 2020.

The 800,000-square-foot fulfillment center became operational in October 2021, with an official ribbon-cutting ceremony in June 2022. Hershey estimated total project costs to be $178 million.

A 287,104-square-foot expansion is currently in the works.

Read More: The Hershey Company seeks approval for expansion of Annville Fulfillment Center

DHL’s Clear Spring Logistics Park

DHL’s Clear Spring Logistics Park will contain 3 million square feet of warehouse space once the planned set of three warehouses is complete.

Through a subsidiary, Exel Inc., DHL acquired the 198-acre site from MFS in August 2022 for approximately $20.1 million. The company estimates that it will spend $283 million on construction of the overall facility.

Questions about this story? Suggestions for a future LebTown article? Reach our newsroom using this contact form and we’ll do our best to get back to you.

Keep local news strong.

Cancel anytime.

Monthly Subscription

🌟 Annual Subscription

- Still no paywall!

- Fewer ads

- Exclusive events and emails

- All monthly benefits

- Most popular option

- Make a bigger impact

Already a member? Log in here to hide these messages

Local news is a public good—like roads, parks, or schools, it benefits everyone. LebTown keeps Lebanon County informed, connected, and ready to participate. Support this community resource with a monthly or annual membership, or make a one-time contribution. Cancel anytime.